What is Medicare part B?

A Straightforward Guide from MediHealth Options

When it comes to Medicare, one of the most important pieces of the puzzle is Medicare Part B. It’s the part of the program that covers everyday medical needs — the kind of care most people rely on throughout the year. But understanding what Medicare Part B actually is, what it covers, and how much it costs isn’t always easy.

At MediHealth Options, we help clients cut through the confusion to find Medicare plans that make sense for their health and budget. In this guide, we break down everything you need to know about Medicare Part B — from coverage details and costs to enrollment timing and plan options.

What Is Medicare Part B?

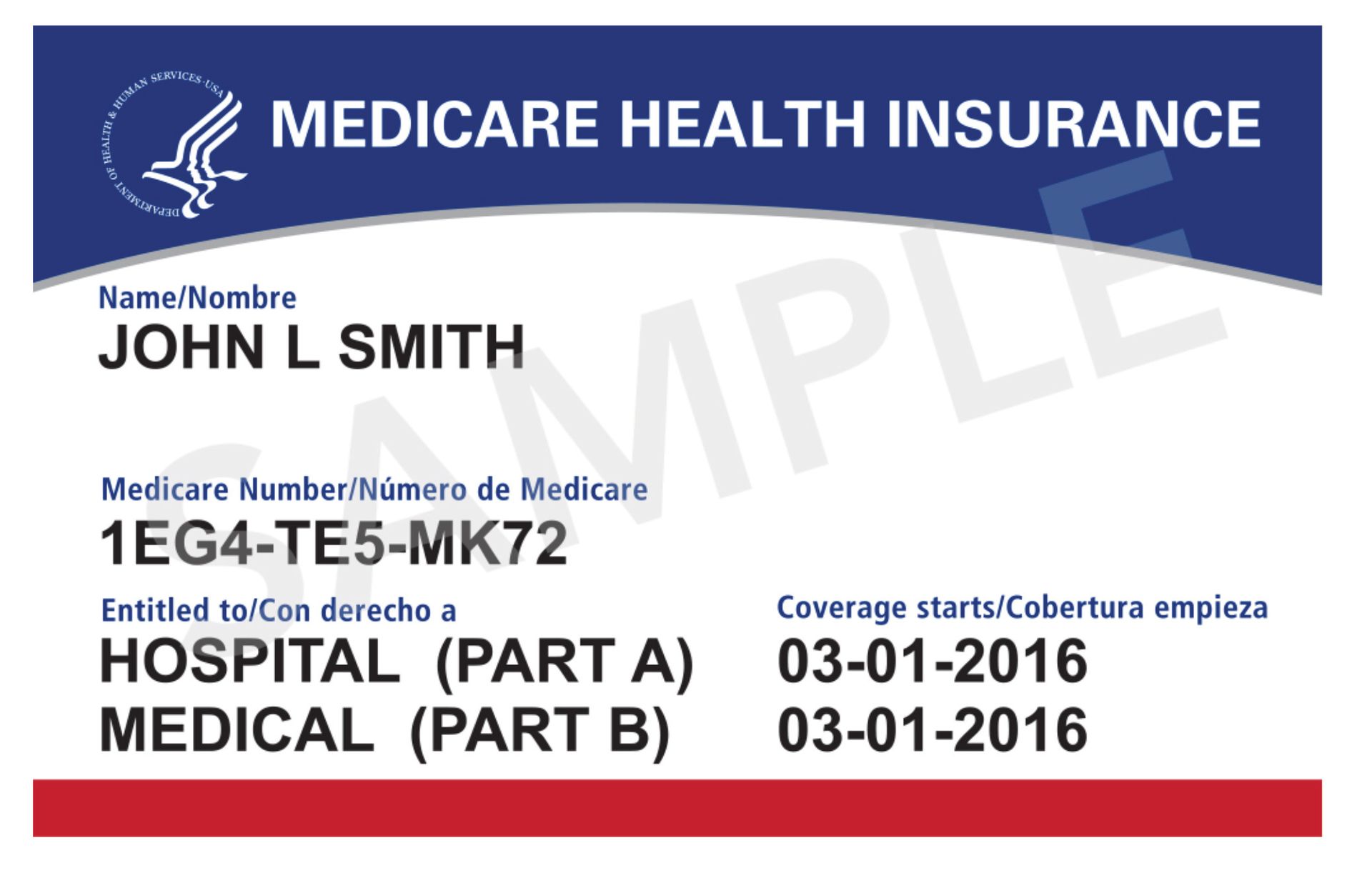

Medicare Part B is one of the two components of Original Medicare, the federal health insurance program primarily for people aged 65 and older, and for certain younger individuals with disabilities.

Where Part A covers hospital-related care (inpatient stays, skilled nursing facilities, hospice), Part B covers outpatient medical services — like doctor’s visits, diagnostic tests, preventive screenings, and more.

You can think of Part B as your day-to-day medical coverage. It pays for services that help you maintain your health, manage chronic conditions, and treat illnesses or injuries that don’t require hospitalization.

At MediHealth Options, we walk you through how Part B fits into your overall Medicare plan and whether a Medicare Advantage or Supplement plan can help enhance your coverage.

What Does Medicare Part B Cover?

Medicare Part B covers a wide range of medical services and supplies that are considered medically necessary or preventive. Below are some of the major categories:

1. Doctor’s Services

- Office visits with primary care doctors or specialists

- Services received in outpatient clinics or medical offices

2. Preventive Services

- Annual wellness visits

- Flu shots, COVID-19 vaccines, and other immunizations

- Screenings for cancer, diabetes, and heart conditions

3. Outpatient Care

- Same-day procedures and surgeries not requiring an overnight hospital stay

- Mental health outpatient services

- Diagnostic lab tests and imaging (e.g., X-rays, MRIs)

4. Durable Medical Equipment (DME)

- Items like walkers, wheelchairs, oxygen equipment

- Must be prescribed by a doctor and used at home

5. Mental Health Services

- Individual and group therapy

- Depression screenings

- Outpatient substance use disorder treatment

6. Emergency Room & Urgent Care (Outpatient)

- If you visit the ER and are not admitted, Part B covers the cost

It's important to know that Medicare Part B does not cover most dental, vision, hearing, or long-term care services. To bridge these gaps, many people work with MediHealth Options to explore Medicare Advantage plans or add supplemental coverage.

Who Needs Medicare Part B?

If you’re eligible for Medicare, whether by turning 65 or due to disability, you’ll likely be given the option to enroll in Part B. And in most cases, enrolling is a smart move — even if you’re healthy.

Why Enroll in Part B?

- You’ll gain access to necessary outpatient care.

- It helps manage chronic conditions and allows for preventive screenings.

- Not enrolling on time can result in permanent late enrollment penalties.

There are a few situations where you might consider delaying enrollment:

- You or your spouse are still working and have employer coverage.

- Your employer group plan meets Medicare’s standards (creditable coverage).

- You plan to use Veterans Affairs (VA) healthcare exclusively — although in most cases, it’s still smart to enroll in Part B for added flexibility.

If you’re not sure whether to enroll or delay, MediHealth Options can assess your specific situation and help you make the right decision.

How Much Does Medicare Part B Cost?

Unlike Medicare Part A, which is usually premium-free, Medicare Part B has a monthly premium — and that’s just the beginning. Let’s break down the cost structure.

1. Monthly Premium

- The standard monthly premium for 2025 is $174.70 (may vary).

- If your income is higher, you may pay more under IRMAA (Income-Related Monthly Adjustment Amount).

2. Annual Deductible

- In 2025, the annual deductible is $240.

- You pay this amount out of pocket before Medicare begins to cover services.

3. Coinsurance

- After meeting the deductible, you typically pay 20% of the cost for covered services.

- There is no yearly out-of-pocket maximum with Original Medicare (unless you have a supplement plan).

Sample Scenario:

If you visit your doctor and the approved cost is $150:

- You pay 20% = $30

- Medicare pays the rest

Because of the 20% coinsurance and no out-of-pocket cap, many people consider adding a Medicare Supplement plan (Medigap) or enrolling in a Medicare Advantage plan that limits their costs. MediHealth Options can help you compare those options.

When and How to Enroll in Medicare Part B

Knowing when to enroll in Medicare Part B is crucial. Delaying without qualifying for an exception can lead to lifetime penalties.

Key Enrollment Periods:

1. Initial Enrollment Period (IEP)

- Starts 3 months before your 65th birthday

- Includes the month of your birthday

- Ends 3 months after your birthday month

- Enroll here to avoid penalties

2. Special Enrollment Period (SEP)

- If you or your spouse are working and covered by a group health plan

- You have 8 months to enroll in Part B after employer coverage ends

3. General Enrollment Period (GEP)

- January 1 to March 31 annually

- Coverage begins July 1

- For those who missed their IEP or SEP

What Happens If You Miss Enrollment?

- You may be charged a late enrollment penalty of 10% for each 12-month period you didn’t sign up.

- This penalty is added to your premium for life.

Don’t take chances with these deadlines. MediHealth Options can guide you through enrollment, especially if you’re unsure about your eligibility or coverage status.

What Are the Alternatives or Add-Ons to Part B?

Medicare Part B alone may not meet all your healthcare needs. That’s why many people combine it with other coverage options.

1. Medicare Advantage Plans (Part C)

- Combine Part A and Part B into one plan

- Often include Part D (drug coverage), dental, vision, and hearing

- May have lower out-of-pocket costs and added benefits

- Run by private insurers approved by Medicare

2. Medigap (Medicare Supplement) Plans

- Help pay for out-of-pocket costs not covered by Original Medicare (Part A and B)

- Includes deductibles, coinsurance, and copays

- Plans vary by state and provider

3. Medicare Part D

- Covers prescription drugs

- Must be added separately if you stay on Original Medicare (A and B)

Choosing between these options can be overwhelming. At MediHealth Options, we help you understand your choices and match you with plans available in your state.

Common Questions and Misconceptions About Medicare Part B

Even people already enrolled in Medicare have questions about how Part B works. Let’s clear up some confusion.

“Do I really need Part B if I’m healthy?”

Yes. You never know when you’ll need outpatient care or a specialist visit. Not enrolling on time can lead to penalties and coverage gaps.

“Isn’t Medicare free?”

No. While Part A is often free, Part B has monthly premiums, deductibles, and coinsurance. Supplemental coverage can help manage those costs.

“Can I drop Part B later?”

Yes, but it’s not recommended unless you have other creditable coverage. Dropping it without a valid reason can lead to penalties and delays in getting coverage again.

“Will Medicare Part B cover my prescriptions?”

Not directly. For drug coverage, you’ll need to enroll in Part D or choose a Medicare Advantage plan that includes drug benefits.

Still unsure? MediHealth Options can answer your specific questions in a one-on-one consultation.

How MediHealth Options Helps You Choose Wisely

Understanding what Medicare Part B is — and how it fits into your full healthcare picture — is just the beginning. The real challenge is selecting the right combination of coverage to protect your health and your wallet.

At MediHealth Options, we offer:

- Personalized plan reviews based on your needs and medications

- Access to multiple plan types and carriers

- Expertise in Medicare Advantage, Medigap, and Prescription Drug Plans

- Licensed support across NY, PA, CT, NJ, NC, and FL

We’re not here to push a plan — we’re here to help you understand your options, avoid costly mistakes, and find the plan that fits your life.

Conclusion: What Is Medicare Part B and Why It Matters

To summarize:

- Medicare Part B is outpatient medical coverage — it pays for doctor visits, tests, preventive care, and more.

- You pay a monthly premium, plus a deductible and coinsurance.

- Enrolling on time is critical to avoid late penalties.

- You may want to add Part D, Medigap, or choose a Medicare Advantage plan.

- Expert help is available at MediHealth Options to guide your decision.

Whether you're getting ready to enroll for the first time or reassessing your coverage, don't go it alone. We're here to help you navigate Medicare with confidence.

📞 Ready to Make Medicare Simple?

Don’t leave your health coverage up to guesswork. Visit MediHealth Options to get clear, personal guidance on Medicare Part B and the plans that go with it.

Book A Free Consultation!

Best Medicare Plans

Contact Info.

Phone Number:

Email Address:

Our Location:

2570 N Jerusalem Rd Ste C5, North Bellmore, NY 11710